Many couples who apply for a divorce don’t quite understand the full extent to how much of their lives needs to be considered, from small things such as monthly outgoings to bigger issues like the division of the matrimonial home, business assets and pensions.

In this guide, we’ll take an in-depth look at all the different issues you should consider in a divorce and how to prepare for them.

What are the main things to consider in a divorce?

Going through a divorce is never an easy process, however, there are certain things you should consider during the divorce process to ensure everything goes as smoothly as possible.

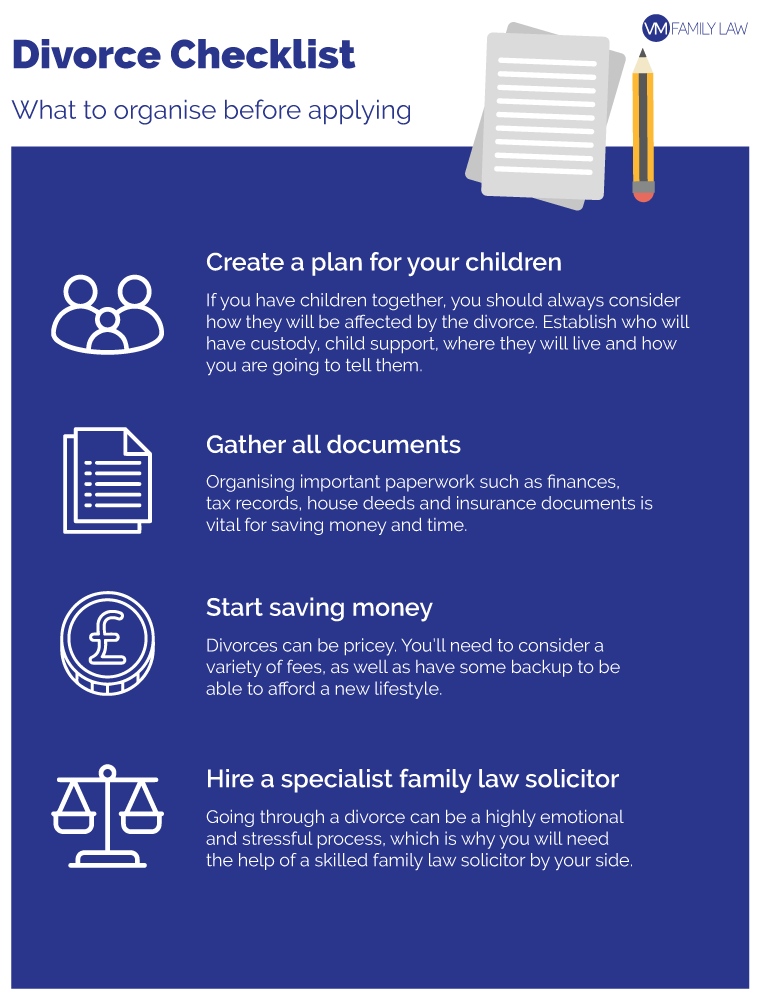

We recommend considering:

- Children – If you and your ex-partner share any children, they should always be your main priority. Ideally, you should establish who is going to be the primary caregiver, as well as ways in which they can have a healthy and consistent relationship with both parents, unless there is a safeguarding concern.

- Income – There are several income issues that you will want to consider including benefits, child maintenance and spousal maintenance.

- Property – The properties owned by you and your ex-partner need to be either sold or kept by one of the parties (the priority will be meeting the housing needs of any dependent children).

- Bank accounts – Joint bank accounts and savings will need special considerations, especially if there is an overdraft facility since both parties could be liable for debt. Agreements should be established on how these accounts should be dealt with and how the money is shared and what is to happen to the accounts thereafter. Are they to be closed or transferred to one party?

- Business Assets – Are these to be retained by one party or sold or transferred?

- Investments – How are these to be divided?

- Pensions – If one party has a larger pension provision than the other party, then should there be a pension sharing order or a lump sum paid to the party with the smaller pension? You should also ensure the names of any beneficiaries under your pension schemes still accord with your wishes.

Wills and spousal agreements – Often, married couples will have wills mirroring one another, gifting their estate to their spouse in the event of their death. When you begin the divorce process, it is likely you will want to make alternative provisions in the event of death. You should therefore review the terms of any existing will, and if you do not have a will, then consider making one.

Managing documents in a divorce

Having a method of organising your divorce documents will not only save you time and money, but it will also help to ensure things run as smoothly as possible.

When you’re going through a divorce, you will likely have a number of different documents that need to be organised, from wills, to solicitor correspondence to property and pension documentation.

Repeatedly asking for the same documents to be re-sent over to you can be costly and a waste of time. Listed below are some of the top methods we recommend using to help you manage your documents:

- Have a dedicated email account – Going through the divorce process can add volume to the number of emails you receive, meaning they can easily be missed or deleted by accident. To save you the hassle of sifting through all your emails, it is a good idea to have a separate email address for the divorce to help you stay organised and only see the documents when you need to.

- Create a digital or physical folder – Having a dedicated folder that you can access at your fingertips will be incredibly useful and will save you a great deal of time, since you don’t have to search for different documents in different places.

If you prefer to have physical documents, make sure you make a folder that is split into categories, such as finances, childcare, property and so on and keep this confidential.

- Create a spreadsheet to keep track of expenses – Tracking expenses comes easier to some than others, and if it is not something you’re used to, it’s a good idea to start. Using a spreadsheet is a very easy way to keep track and add up these expenses. You should keep a separate record of expenses relating to children.

Managing finances in a divorce

Managing finances in a divorce isn’t always as simple as expected, and many divorcing couples will end up with quite a complex case.

Seek advice as soon as possible

We always recommend seeking legal advice for finances during a divorce to help you establish matrimonial and individual assets. Our team at VM Family Law can help with financial settlements during a divorce and advise you about the best process for you to achieve the best possible settlement.

Start by noting down your joint and individual assets, including any pensions. This will ensure the legal advice you receive is based on accurate information.

Get specialist mortgage advice

It may be that you need to look to raise a mortgage in order to keep any existing property or purchase a new property. It will therefore be important to understand your borrowing capacity and what you can afford by way of a mortgage.

Get specialist advice about your pensions

The way in which your pensions are split can have a long-lasting impact on your financial security, which is why it is so important to take the time to understand your options and seek professional financial advice.

Pension sharing is often the preferred method of dividing pensions and it helps to achieve a clean break since the assets are immediately divided. When pension sharing is granted, each party can decide independently what they would like to do with their share dependent on the rules of the pension schemes involved.

Get specialist accountancy advice

If there are any businesses involved, then consideration should be given as to whether there needs to be a valuation by a forensic accountant and if so, if this should be by way of appointing a single joint expert.

The taxation consequences of any settlement needs to be factored into the settlement and therefore, expert tax advice should always be sought.

Assess your savings and investments

In addition to your pension, you may also have other savings and investments that could form part of your financial settlement.

Splitting your cash savings accounts is usually relatively straightforward because one partner can simply transfer the money from their account to the other partner’s account.

If you have an ISA together, the money will need to be withdrawn first and then given to your partner. Depending on the ISA, you may need to split the cost of an early withdrawal fee. If you have shares, then the timing on when to encash these can be important and the taxation consequences of doing so should always be considered and expert advice obtained.

Managing children in a divorce

Managing child arrangements during a divorce is one of the most important factors that needs to be considered.

It is usually easier, cheaper and less emotionally draining for everyone involved to reach an amicable agreement about your children. You don’t need to put an agreement in writing, but some of the things you should start considering include:

- Who the children will live with

- How much time they will spend with each parent

- If other forms of contact will be used, such as Facetime and calls

- Where they will spend special occasions, such as Christmas and birthdays

It is also worth agreeing arrangements with grandparents and wider family members if they provide a caring role in the child’s life.

Child Arrangement Orders

If an agreement can’t be made direct, then you should consider seeking the help of a trained mediator or a solicitor to assist in the negotiations. If it is still not possible to agree to the arrangements, then you can apply to court for a child arrangement order.

You should always plan to agree on matters relating to your children amicably, but if you know there are going to be issues, then being prepared for a child arrangement order won’t cause any harm. Remember, the court cannot be biased to either parent and they will only act in the best interest of the children.

Managing assets in a divorce

Part of your divorce will include establishing which assets are matrimonial and which are individual.

A good place to start is by itemising the assets that you obtained before the marriage, as well as assets you bought or inherited personally during the marriage.

Division of the matrimonial home

The matrimonial home can be dealt with in several ways:

- It can be transferred to one of you if this is affordable.

- It can be sold and the equity divided in a fair manner.

- It can be kept by one party to be lived in, with the children if you have them until they finish education, then it is divided fairly between the two of you. Or, in certain rare cases, it can be retained by one party until remarriage or for the duration of their life.

Our Family Law and Divorce solicitors can help you through your divorce, navigating the issues around splitting assets and managing children. Speak with our friendly and professional team today for more support and expert advice.